As such, volume and liquidity are crucial for day trading. Even so, there are some day traders that base their strategy around "trading the news." This involves finding assets with high volume thanks to a recent announcement or piece of news and taking advantage of the temporary spike in trading activity.ĭay traders aim to profit off of market volatility. As with any trading strategy, risk management is essential for success in day trading.Īs fundamental events may take a long time to play out, day traders may not concern themselves with fundamental analysis (FA). They will usually use volume, price action, chart patterns, and technical indicators to identify entry and exit points for trades. Day traders will typically use technical analysis (TA) to create trade ideas. Successful day traders will have a deep understanding of the market and a good chunk of experience. In this context, day traders never leave positions open overnight since they aim to capitalize on intraday price movements. The term "day trader" originates from the stock market, where trading is open only during business days of the week.

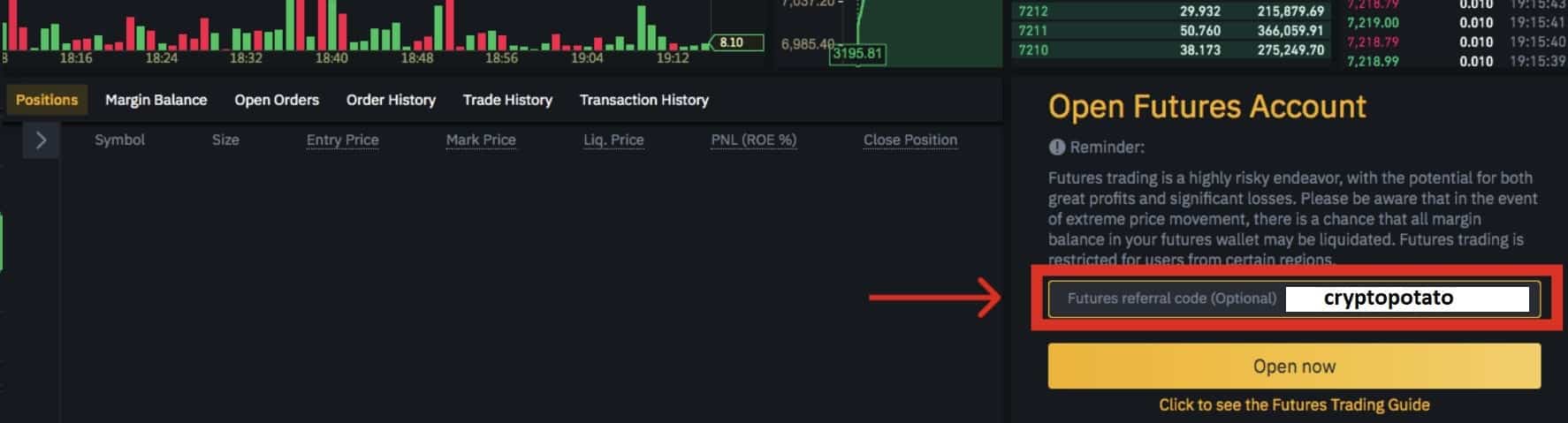

The goal of day traders is to use intraday trading strategies to try and profit off of price changes in a financial instrument. Since the trading happens within the same day, this strategy may also be referred to as intraday trading. What is day trading?ĭay trading is a trading strategy that involves entering and exiting positions on the same trading day. Unfortunately, we don’t have a single answer to those questions, but this article will explain what you need to know before you start day trading crypto. But is day trading cryptocurrency a good idea for you? How do day traders make money? Should you start day trading? Day traders are active in most financial markets, such as stocks, forex, commodities, and of course, cryptocurrency markets. So the basic rule is that US customers can’t trade crypto derivatives, and big international crypto derivatives exchanges (Binance, FTX before it blew up) sometimes have US-only platforms (Binance US, FTX.us) that let US customers trade a limited set of products, but not most derivatives.Day Trading is entering and exiting positions on the same trading day.ĭay trading is one of the most commonly used trading strategies. It is illegal to run a crypto derivatives exchange in the US without registering it with the CFTC, and it’s not exactly easy to do that either if you have a crypto derivatives exchange abroad but have not registered it in the US, it is illegal to let US customers trade on it. No, the CFTC’s case is mainly about letting US customers trade crypto derivatives.

There are … look, there are not no accusations that Binance is laundering money for terrorists or secretly trading against its customers, but there are relatively few accusations like that again, as crypto exchanges go, that’s pretty good. There are no accusations that Binance is stealing customer money, or even taking big risks with it, which makes Binance look better than some other crypto exchanges I could name. Today the US Commodity Futures Trading Commission sued Binance Holdings Ltd., Changpeng Zhao’s big crypto derivatives exchange, for letting Americans trade crypto derivatives. A decent rule of thumb is that all cryptocurrency exchanges are doing crimes, and if you’re lucky your exchange is doing only process crimes.

0 kommentar(er)

0 kommentar(er)